- The Fascinating World of Slot Games: History, Evolution, and Modern Trends

- Slot Games: From Mechanical Reels to Digital Entertainment Powerhouses

- Slot Games: History, Evolution, and the Thrill of Chance

- The Fascinating World of Slot Games: History, Evolution, and Modern Appeal

- The Fascinating World of Slot Games: History, Evolution, and Modern Innovations

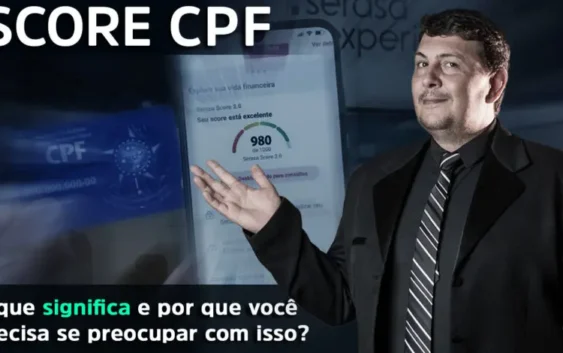

Understanding Doutor Score

Your Doutor Score it is one of the most critical factors in your financial life. It determines if you will approved for a loan or line of credit. A credit score is a mathematically calculate number develope by the Fair Isaac Corporation (FICO) that lenders use to rate potential customers in determining the likelihood that a customer will pay their bills on time. A credit score or credit rating is determined by using five main criteria as define by MyFico.com: your payment history which accounts for 35% of your credit score, the amounts owed which accounts for 30% of your credit score, the length of your credit history which accounts for 15% of your credit score, new credit which accounts for 10% of your credit score, and the types of credit use which accounts for 10% of your credit score.

Payment history shows the history of how you paid your bills either on time or late but unfortunately does not show if your bills were paid before the due date. Amounts owed shows the total amount of credit you have available. If your balance is near the credit limit this may lower your credit score. The length of history indicates how long you have had credit. If your credit history is 2 years or less could lower your credit score. New credit indicates how many times you have applied for new credit. If you open two many new accounts in a short period of time this may lower your credit score. The types of credit used indicate the types of accounts you have such as revolving or installment accounts. Revolving accounts are usually credit cards and installment accounts are usually mortgages, auto loans, etc.

The FICO credit score model ranges from 300-850 with 850 being an excellent score and 300 being the worst score. The higher the credit score the lower the interest rate you will receive for a loan or line of credit. Having a good credit score can save you thousands of dollars in interest over the life of the loan or line of credit. A good credit score is generally in the range of 660-749 but may vary from lender to lender.